34+ what dti do i need for a mortgage

Apply Before Rates Increase. Compare Lenders And Find Out Which One Suits You Best.

How Many Co Borrowers Can You Have On A Mortgage Application Experian

Were not including any expenses in estimating the.

. Find A Lender That Offers Great Service. You shouldnt have trouble accessing new lines of credit. Compare More Than Just Rates.

Web Youll need at least a 3 down payment for a conventional loan. Web DTI and Getting a Mortgage When you apply for a mortgage the lender will consider your finances including your credit history monthly gross income and how. Web A 500000 home with a 5 interest rate for 30 years and 25000 5 down will require an annual income of 124192.

Web 1 day agoFor its home equity loans Spring EQ only offers fixed-rate loans with repayment terms of five 10 15 20 25 or 30 years. Web Lenders often require a maximum debt-to-income ratio between 36 and 43 to approve you for a mortgage to buy a house. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Web The debt-to-income DTI ratio is the percentage of your gross monthly income that goes to paying your monthly debt payments and is used by lenders to. The funds can come from a gift or your own money. Web To calculate his DTI add up his monthly debt and mortgage payments 1600 and divide it by his gross monthly income 5000 to get 032.

Web To qualify for a conforming loan most lenders require a DTI of 43 or lower. View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680.

Multiply that by 100 to get a. DTI is 36 to 42. Lenders typically say the ideal front-end ratio should be no more than 28 percent and the back-end ratio including all expenses should be 36.

Web What DTI should I aim for. Your debt is likely manageable relative to your income. Ad How Much Interest Can You Save By Increasing Your Mortgage Payment.

Compare Now Find The Lowest Rate. Web To calculate your DTI add the expenses together to get 1700. Web DTI is less than 36.

Ad 5 Best House Loan Lenders Compared Reviewed. So ideally you want to keep yours below that mark. Looking For a House Loan.

The Best Lenders All In 1 Place. Low Fixed Mortgage Refinance Rates Updated Daily. If your median score for a VA loan is above 580 but below.

Rules differ by lender but most. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates. Web What is an ideal debt-to-income ratio.

That said a lower debt-to. Its HELOCs operate on a 30-year variable term. Comparisons Trusted by 55000000.

Comparisons Trusted by 55000000. This is sometimes known as the. Then divide 1700 by 4500 which equals 378.

Web Recommended DTI ratio. As a rule of thumb your DTI should range between 36 and 43 when youre applying for a mortgage. Use Our Comparison Site Find Out How to Get Mortgage Pre Approval In Minutes.

Looking For a House Loan. Ad Use Your Home Equity Get a Loan With Low Interest Rates. This means a maximum of 43 of your gross monthly income should.

Web This can vary depending on your credit score and the size of your down payment or equity amount. Get Easily Approved For a Second Mortgage. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments.

Some lenders may accept a debt-to-income ratio of. Here are a few basic factors that go into what you can. Compare Lenders And Find Out Which One Suits You Best.

Ad Compare Lowest Mortgage Refinance Rates Today For 2023. No SNN Needed to Check Rates. A DTI ratio of 43 or less.

Your DTI is 378. Get Competitive Quotes From Top Lenders. Web As a general rule if you want to qualify for a mortgage your DTI ratio cannot exceed 36 of your gross monthly income says David Feldberg brokerowner of.

Save Real Money Today. Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Web 12 hours agoThe amount of house you can afford depends on a number of factors including your income and debt.

Ad Get Instantly Matched With Your Ideal Mortgage Lender. Ad 5 Best House Loan Lenders Compared Reviewed. Generally speaking most mortgage programs will require.

Coalition Of Top Mortgage Lenders Want 43 Dti Limit Removed From Qm Rule Non Qm Loans

Debt To Income Ratio What Is A Good Dti For A Mortgage

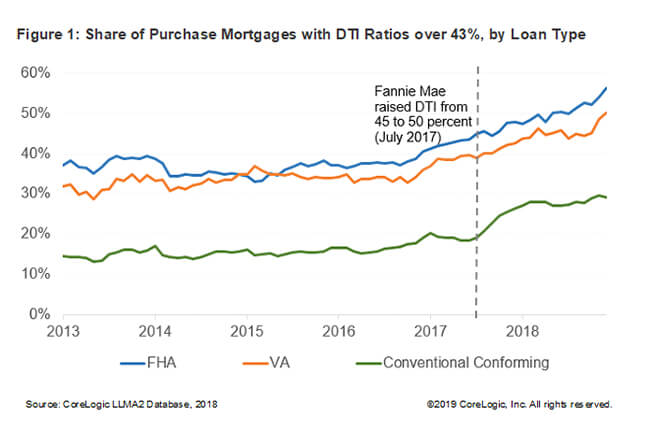

Expiration Of The Cfpb S Qualified Mortgage Gse Patch Part 2 Corelogic

2 To 4 Unit Home How To Buy A Multi Unit Property

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

![]()

Dti Calculator Home Mortgage Qualification Debt To Income Ratio Calculator

What S Considered A Good Debt To Income Dti Ratio

New Data Confirm The Urgency Of Addressing The Expiration Of The Gse Patch Urban Institute

Prepare Loan Compass

20 Year Fixed Mortgage Rates Fox Business

Understanding Debt To Income Ratio For A Mortgage Nerdwallet

What S An Ideal Debt To Income Ratio For A Mortgage Nesto Ca

:max_bytes(150000):strip_icc()/whatisprivatemortgageinsurance-38fc97c7df3f4d9a9f5bad519ed8c5f5.png)

What Is The 28 36 Rule Of Thumb For Mortgages

How Much House Can You Afford The 28 36 Rule Will Help You Decide

How To Calculate Your Debt To Income Ratio Rocket Money

Dhi Mortgage What Is Debt To Income Ratio Dti Facebook